Tourexpi

Thanks

to robust customer demand, underlying EBITA increased by 33 per cent

year-on-year to 1.3 billion euros. Revenue was up 12 per cent year-on-year to

23.2 billion euros (previous year 20.7 billion euros). All Group segments, in

particular Hotels & Resorts as well as Cruises, contributed to this

positive operational performance.

Sebastian

Ebel, CEO of TUI: ‘We have delivered what we promised. 2024 was a very good

year for us. Our focus on operational excellence, rapid implementation of the

defined measures to improve earnings and transformation will continue to

deliver significant growth. The TUI of tomorrow is well positioned. In the

financial year 2024, we achieved important milestones: In the Holiday

Experiences segment, we are growing with our asset-right strategy. We are

future-proofing the tour operator business in the Markets + Airline segment and

positioning it dynamically. Of course, we will continue to focus on package

holidays and our good cooperation with travel agencies. In all our activities,

customer satisfaction and quality are our top priorities. In what remains a

challenging market environment, the entire TUI team has shown that we have the

right strategy, the right business model and the right people, who work for our

guests every day with commitment, creativity and passion. Our goal remains to

become more profitable, more efficient and stronger in all segments with TUI –

and to do so globally. One topic that plays an important role in all our

activities is sustainability. As one of the world's leading travel groups, we

want to set the standard for sustainability in the market. We are continuing

initiatives across our business to deliver on our SBTi (Science Based Targets

Initiative) 2030 targets.’

Mathias

Kiep, Chief Financial Officer of TUI Group: ‘We look back on a successful

financial year 2024, in which we also significantly improved our financial

profile. The positive cash flow resulted in a significant reduction in net

debt. With a leverage ratio of 0.8x, we remain on track to achieve our

medium-term target of strongly below 1.0x. We also expect a positive

development for the new financial year 2025[1]. Our guidance here include a

year-on-year increase in revenue of 5-10 per cent and an increase in underlying

EBIT of 7-10 per cent, particularly supported by the expectations for summer

2025.’

Segment

overview: Results for the full year 2024

In

financial year 2024 (1 October 2023 to 30 September 2024), travel remains

highly popular with our customers. This has had a positive impact on our

operating business. A total of 20.3 million customers travelled with TUI

(previous year: 19.0 million customers). Underlying EBIT for the full year 2024

climbed to 1.3 billion euros (previous year: 977 million euros). Revenue rose

by 12 per cent to 23.2 billion euros (previous year: 20.7 billion euros).

In Holiday

Experiences, which comprises Hotels & Resorts, Cruises and TUI Musement,

underlying EBIT rose by 270 million euros year-on-year to 1.1 billion euros

(previous year: 822 million euros). Hotels & Resorts surpassed

its already strong operational performance of the prior year with an underlying

EBIT of 668 million euros (previous year 549 million euros). The results were

driven by an improved operational performance across its key brands, in

particular Riu. Average daily rates grew by 7 per cent year-on-year to 93

euros.

The Cruises sector

comprises the TUI Cruises joint venture with the brands Mein Schiff and

Hapag-Lloyd Cruises in Germany alongside our wholly owned Group subsidiary

Marella Cruises in the UK. Growth in this segment is driven by investments in

new builds for TUI Cruises. With the launch of Mein Schiff 7 in June, the fleet

size rose to a total of 17 ships. In the reporting period, underlying EBIT rose

significantly to 374 million euros (previous year 236 million euros). Occupancy

over our three brands TUI Cruises, Hapag-Lloyd Cruises and Marella Cruises was

99 per cent on average (previous year 94 per cent), while available passenger

cruise days rose overall by 2 per cent to 9.7 million (previous year 9.5

million).

TUI

Musement, the tours and activities business, offers experiences (excursions,

activities and tickets), transfers and multi-day tours in both popular cities

and beach destinations. In the reporting period, the division increased its

underlying EBIT to 49 million euros (previous year: 36 million euros). A total

of 10 million excursions, tours and activities were sold (previous year: 9.4

million). The number of transfers rose by 8 per cent to 30.5 million.

In

the Markets + Airline business unit, which comprises TUI tour

operators in the Northern (UK, Ireland, Sweden, Norway, Finland, Denmark),

Central (Germany, Austria, Switzerland, Poland) and Western (Netherlands,

Belgium and France) regions, demand remained robust throughout the year in a

highly competitive environment, with overall customer numbers up and prices

higher. In addition, the return to a normal hedging policy had a positive

impact on earnings. As a result, underlying EBIT in this sector improved by 66

million euros to 304 million euros (previous year 238. million euros).

In

the Northern Region with TUI UK&I, underlying EBIT more than

doubled to 165 million euros (previous year: 71 million euros). The Central

Region with TUI Deutschland again delivered a positive result, with

underlying EBIT of 128 million euros. In the prior year, earnings totalled 88

million euros. Underlying EBIT in the Western Region totalled 10

million euros (previous year 79 million euros). This result was impacted by a

decline in long-haul customer numbers in both the Netherlands and Belgium, as

well as costs associated with the ongoing transformation of the business,

including higher IT investments and valuation effects.

The

transformation of Markets + Airline was significantly accelerated in the period

under review with the introduction of a new organisational structure. The aim

is to develop it into a tourism marketplace with a focus on package tours. TUI

customers will be able to choose from an even broader product portfolio in

future. Since 1 October, the Commercial and Marketing divisions have been

managed centrally. The Commercial division encompasses all global purchasing

activities (hotel and flight). Marketing, sales and capacity planning remain

regional responsibilities. In addition, the Expansion Businesses division has

been introduced to take care of the Group's growth outside the current

portfolio. In addition, the Airline is to be given more commercial responsibility

in the future to take advantage of opportunities for its own airline in the

rapidly changing airline market. ‘We see opportunities for new growth through

additional customers in markets that have so far been focused on as holiday

destinations only. In these countries, we are becoming a travel provider for

the local population. Good examples of this are TUI Iberia with Latin America,

as well as our hotel growth regions with their clusters in Africa and Asia.

This reduces our regional dependence on Europe at a time when the European

economy is growing little or not at all,’ said Sebastian Ebel. The Group's

integrated business model with the two business segments Markets + Airline and

Holiday Experiences will continue to create significant added value for

employees, partners and shareholders.

Winter

bookings remain strong with Summer also looking promising

Bookings

for Winter 2024/25 have maintained the levels previously published, up 4 per

cent. 62 per cent of the winter programme has been sold, which in line with

prior year. Average selling prices are up +5 per cent, supported by the

increased share of package holidays and dynamically packaged products in the

sales mix. Summer 2025 bookings are still at a very early stage, with 17 per

cent of the summer programme currently sold which is in line with last year.

Bookings are up +7 per cent for Summer 2025, with average selling prices +3 per

cent higher.

Guidance

for full year 2025

The

focus remains on operational excellence, execution and transformation, and a

commitment to delivering profitable growth. The guidance is based on delivering

further sustainable growth in Holiday Experiences and the transformation of

Markets + Airline and is supported by the current positive trading momentum. On

this basis, the Group provides the following guidance for the financial year

2025[1]:

·

an increase in revenue of 5-10 per

cent year-on-year,

·

underlying EBIT up 7-10 per cent on

the prior year, driven by Summer 2025 expectations.

·

In the medium term, TUI expects:

·

to generate an underlying EBIT growth

of c. 7-10 per cent CAGR,

·

a net leverage of strongly below 1.0x,

·

a return to a credit rating in line

with the pre-pandemic BB/Ba (Moody's/S&P) rating

[1]Based

on constant currency and within the framework of the macroeconomic and

geopolitical uncertainties currently known.

Image

Credit: © TUI Group

The most interesting news

Read the News

Read the News

Ryanair launches Summer 2026 schedule for Alicante with three new routes

Airline expands to 89 routes and over 580 weekly flights, increasing capacity by 10 per cent

Read the News

Read the News

Lufthansa A380 unveiled with XXL crane for 100th anniversary

Fourth aircraft in special blue livery enters service from March

Read the News

Read the News

TAT confirms Tomorrowland Thailand debut in December 2026

Full-scale Asian edition to take place in Pattaya with six stages and major economic impact

Read the News

Read the News

Eurowings expands Dubai service from Berlin and launches new Rome route

Airline extends Gulf flights into summer and grows to 47 destinations from BER

Read the News

Read the News

Amadeus acquires SkyLink to scale AI-driven travel solutions

Acquisition strengthens conversational automation and accelerates practical AI adoption across the travel ecosystem

Read the News

Read the News

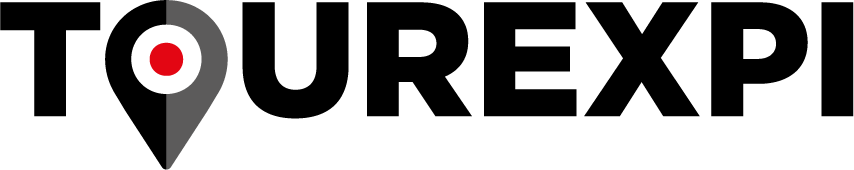

ITB Berlin and IPK: International travel grows four per cent, South America leads

World Travel Monitor® confirms stable demand, holidays remain dominant, business travel reaches 2019 levels

Read the News

Read the News

Turkish airlines suspend flights to five Middle Eastern countries until 6 March

Carriers reroute services as regional airspace closures remain in force

Read the News

Read the News

TAT activates Tourism Crisis Monitoring Centre in response to Middle East tensions

Integrated coordination ensures timely assistance and structured support for affected travellers

Read the News

Read the News

Qatar Airways temporarily suspends flights due to Qatari airspace closure

Airline to resume operations once authorities confirm safe reopening

Read the News

Read the News

German Travel Trends Summer 2026: Early bookings, Mediterranean in focus, cruises on the rise

Turkey remains the top destination for German travellers, long-haul demand shows mixed signals

Read the News

Read the News

UN Tourism opens applications for Best Tourism Villages 2026

Member States invited to nominate up to eight rural destinations by 9 June 2026

Read the News

Read the News

Beaches Resorts opens Treasure Beach Village in Turks and Caicos

US $150 million expansion adds 101 multi-bedroom suites and new dining concepts

Read the News

Read the News

ITB Berlin 2026 marks 60 years as a global platform for tourism and innovation

Nearly 6,000 exhibitors from over 160 countries gather in Berlin for the anniversary edition

Read the News

Read the News

TUI Global Hotel Awards 2026 honour outstanding hotels worldwide

More than 20 million TUI guests helped select the best hotels across 22 categories

Read the News

Read the News

Celebrity Cruises relaunches Celebrity Solstice with new experiences

Revitalized ship introduces new venues, upgraded cabins and expanded itineraries

Read the News

Read the News

Ritz-Carlton Yacht Collection unveils Asia and Alaska voyages for summer 2027

Luxury yacht Luminara will sail 21 itineraries across two regions

Read the News

Read the News

Ryanair urges new Dutch government to abolish aviation tax

Airline says €30 levy undermines competitiveness and regional connectivity

Read the News

Read the News

April–May in Taipei: Danjiang Bridge opens a new urban experience

Pre-opening events invite visitors onto the landmark bridge before traffic begins

Read the News

Read the News

Ryanair expands Kraków base with three additional aircraft for summer 2026

Four new routes and increased frequencies expected to boost traffic to eight million passengers

Read the News

Read the News

Delta opens new Sky Club at Denver International Airport

New premium lounge reflects Colorado’s landscape and culture

Read the News

Read the News

ITB Berlin 2026: Host Country Angola opens anniversary edition with gala show

Cultural performances and high-level guests mark the 60th anniversary of the world’s leading travel trade show